2016 is coming to the end with few days remaining. What an eventful year with the continuation of Oil Crisis, Brexit, Trump's presidency, Italy referendum and Interest rate hikes. What 穷小子 had accomplished?

Financial's achievement

Savings

Manged to save about 44% of his salary after all the insurances and household allowance deductions. Target to save 50% for 2017. Not sure if this can be done, but since if 穷小子 can't save more, why not try to earn more to bring up the ratio.

With the 44% of savings this year, he managed to build back the "emergency funds" which he had used last year for investments, and with some bad choices were made. As long as 穷小子 is still working, he will build them back, as a promise to himself.

The emergency funds used a 6 months' expenses as a guide, shall proceed with 12 months' expenses target by end of 2017

Putting all these aside, 穷小子 also managed to deposit $10,000 in a joint account with his loves ones. This amount is untouchable and shall continue to grow, for the house and renovations, and hopefully can get a good queue number from the government.

Investment

Had began to analyse the financial results. Starting off with OCBC's and M1's. Shall continue with the final year results which will be out some where around next April with 穷小子's noob's analyst skills.

Health's accomplishments

Participated 3 runs this year with 10KM each, Safra Run, Yolo Run, and Stanchart Marathon. All participated but yet to achieve the below 1 hour mark target. Feels body is getting older each year.

Anyway, at least 穷小子 cleared the IPPT for last birthday year, but have not attempt any for this birthday year. Gotta start training now. Target for another Silver award!!

Self-Improvement's achievement

Purchased another Peter Lynch's book few months back. Target to finish it by this year initially, but change of plans to take some certifications with relevance to 穷小子's career instead. Now we are at the last month of the year, neither did 穷小子 got his certifications nor completing the book. Reading is just not one of his traits. Too much work involvements or simply just too lazy to get it started.

Year 2016

Total dividends collected: S$4,365.35

Average dividends per month: S$363.77

Average dividends per day: S$11.92

Happy New Year~~

I decided to start this blog to remind myself on how much I had learned investing through the hard way. I don't have a strong finance background, but wish to achieve financial freedom by investing. Perhaps most of my stocks-picking are based on my own logics and concepts which I had learned. My belief is 穷小子日记, I may be poor in appearance, but rich in pocket and knowledge, and it’s all that matters.

Friday 30 December 2016

Thursday 22 December 2016

Christmas Shopping

穷小子 is having his festive seasons shopping for the past few weeks. Shopping for gifts for friends, families, and self. Mainly being to Raffles City, Bugis, Vivocity, Waterway Point, Suntec. Managed to get a perfect gift for everyone, and with much shopping malls rewards points accumulations as well as credit cards rebates. Most importantly, 穷小子 had bought most of the REITS from his watchlists too. Yay! Interest rate hikes was over for this year, but do anticipate to have three rate hikes in 2017 with Fed's projection.

CapitaLand Mall Trust

CapitaLand has always been one of 穷小子's favourite shopping organisations. CapitaLand Mall Trust has 16 properties leading famously with Bugis, Plaza Singapura and Raffles City. This is in the top of 穷小子's target list. Snap it impatiently with slightly above book value immediately after the rate hikes news last week. The price had dropped about 1.8% after since, but nonetheless, 穷小子 is comfortable with the 5.77% yield. Looking out for this if it drops more. On side note, CapitaLand is 穷小子's first stock after all, long time supporter.

Mapletree Commercial Trust

穷小子 must admit that this was never in his watchlist until recently. 穷小子 went Vivocity to shop for the presents and notice that the crowd was overwhelming. Not that we didn't know that it is popular, but the crowd was still impressive every time 穷小子 visited it, and even after 10 years of operation. Vivocity holds a significant position in the southern part of Singapore. It is a bottleneck passage towards Sentosa, one of Singapore's iconic tourist attractions. Every visitors would need to pass through Vivocity to get into Sentosa, either by the Sentosa Express or by walking. If one would want to have a cheaper decent meal out from Sentosa, the nearest will be Vivocity.

On top of all these, there is Harbourfront Ferry Terminal which is just right next to it. Another group of crowd formed by tourists and locals who want to get into Batam or cruise.

Vivocity, Singapore's largest mall, will never be lacking of crowds with all these strategic advantages.

Another plus point is the diversification of Mapletree Commercial Trust. It has 5 properties only, but ranging from retail, to CBD offices, business park. On the downside, 穷小子 had paid about 6% premium to its book value for this. Will not be adding any more unless the next purchase is below its book value.

Fraser Centrepoint Trust

It comprises six suburban malls, Causeway Point, Northpoint, Changi City Point, Bedok Point, YewTee Point and Anchorpoint. 穷小子 had not personally visited any of these in the past weeks yet, but mainly inspired by The Centrepoint and Waterway Point, both which are under its parent's flagship. Likes with the new Centrepoint, a more open-concept layout with more F&B outlets after its renovations. Yes, Punggol Waterway point again, as blogged previously. Pinning on hopes that Fraser Management will inject Waterway point into Fraser Centrepoint Trust, to become the seventh "Point". Comfortably with about 6.2% yield and paid slightly lower than its book value.

Suntec Reit

Suntec City used to live in a shadow behind Raffles City and Marina Square, because of its accessibility disadvantages, losing out to both malls which are nearer to City Hall Station. The game had changed ever since the opening of Circle Line, and also with the completion of its renovations.

One of Promenade Station's exit is just right in front of Tower 3 entrance. Another would be Esplanade Station which is pretty close to the Convention Tower. 穷小子's observations is that the 2 stations' exits are bringing more crowd nowadays, more than City Hall's. Suntec is making good use of its good strategic location, and with the conventions halls filled with events all year round.

Did a small purchase last month before the rate hikes, but the price never come back ever since. Didn't add any more new positions this time round, but this definitely still within 穷小子's top reits target.

Glad that had "ate" some last month, so not in hurry to "eat" again.

CapitaLand Commercial Trust

Had reduced 40% of CapitaLand Commercial Trust about 3 months ago, after it had a great run to $1.64. 穷小子 is definitely happy to have it back before end of the year. Of course didn't get it back at the $1.45 low last month, due to too much fear about the rate hikes. Do not time the market. Haha.. Anyway, at 5.8% yield with about 15% discount to its book value is good enough for now.

With all the REITs purchased, 穷小子 shall close shop for this year. Let's see how the market react to the new year ahead. Total REITs' holding is at about 33% of the whole portfolio currently. Will be more mindful for any more REITs increase as 穷小子 don't wish REITs to be over-weighted.

Merry Christmas and a Happy New Year!!

CapitaLand has always been one of 穷小子's favourite shopping organisations. CapitaLand Mall Trust has 16 properties leading famously with Bugis, Plaza Singapura and Raffles City. This is in the top of 穷小子's target list. Snap it impatiently with slightly above book value immediately after the rate hikes news last week. The price had dropped about 1.8% after since, but nonetheless, 穷小子 is comfortable with the 5.77% yield. Looking out for this if it drops more. On side note, CapitaLand is 穷小子's first stock after all, long time supporter.

Mapletree Commercial Trust

穷小子 must admit that this was never in his watchlist until recently. 穷小子 went Vivocity to shop for the presents and notice that the crowd was overwhelming. Not that we didn't know that it is popular, but the crowd was still impressive every time 穷小子 visited it, and even after 10 years of operation. Vivocity holds a significant position in the southern part of Singapore. It is a bottleneck passage towards Sentosa, one of Singapore's iconic tourist attractions. Every visitors would need to pass through Vivocity to get into Sentosa, either by the Sentosa Express or by walking. If one would want to have a cheaper decent meal out from Sentosa, the nearest will be Vivocity.

On top of all these, there is Harbourfront Ferry Terminal which is just right next to it. Another group of crowd formed by tourists and locals who want to get into Batam or cruise.

Vivocity, Singapore's largest mall, will never be lacking of crowds with all these strategic advantages.

Another plus point is the diversification of Mapletree Commercial Trust. It has 5 properties only, but ranging from retail, to CBD offices, business park. On the downside, 穷小子 had paid about 6% premium to its book value for this. Will not be adding any more unless the next purchase is below its book value.

Fraser Centrepoint Trust

It comprises six suburban malls, Causeway Point, Northpoint, Changi City Point, Bedok Point, YewTee Point and Anchorpoint. 穷小子 had not personally visited any of these in the past weeks yet, but mainly inspired by The Centrepoint and Waterway Point, both which are under its parent's flagship. Likes with the new Centrepoint, a more open-concept layout with more F&B outlets after its renovations. Yes, Punggol Waterway point again, as blogged previously. Pinning on hopes that Fraser Management will inject Waterway point into Fraser Centrepoint Trust, to become the seventh "Point". Comfortably with about 6.2% yield and paid slightly lower than its book value.

Suntec Reit

Suntec City used to live in a shadow behind Raffles City and Marina Square, because of its accessibility disadvantages, losing out to both malls which are nearer to City Hall Station. The game had changed ever since the opening of Circle Line, and also with the completion of its renovations.

One of Promenade Station's exit is just right in front of Tower 3 entrance. Another would be Esplanade Station which is pretty close to the Convention Tower. 穷小子's observations is that the 2 stations' exits are bringing more crowd nowadays, more than City Hall's. Suntec is making good use of its good strategic location, and with the conventions halls filled with events all year round.

Did a small purchase last month before the rate hikes, but the price never come back ever since. Didn't add any more new positions this time round, but this definitely still within 穷小子's top reits target.

Glad that had "ate" some last month, so not in hurry to "eat" again.

CapitaLand Commercial Trust

Had reduced 40% of CapitaLand Commercial Trust about 3 months ago, after it had a great run to $1.64. 穷小子 is definitely happy to have it back before end of the year. Of course didn't get it back at the $1.45 low last month, due to too much fear about the rate hikes. Do not time the market. Haha.. Anyway, at 5.8% yield with about 15% discount to its book value is good enough for now.

With all the REITs purchased, 穷小子 shall close shop for this year. Let's see how the market react to the new year ahead. Total REITs' holding is at about 33% of the whole portfolio currently. Will be more mindful for any more REITs increase as 穷小子 don't wish REITs to be over-weighted.

Merry Christmas and a Happy New Year!!

Monday 21 November 2016

Combo Banks Sold!!

穷小子 had sold some of his banks shares last week after combo Reits purchased earlier. Not all, but sold about 1/3 of DBS and 1/3 of OCBC from the overall portfolio. This move is to re-balance his portfolio, 穷小子 still have confident in our local banks for long term.

Moreover, last week is also seems to be a good opportunity to cash out to build up the warchest, after some good run on these 2 banks for the past recent days.

After these sell off, OCBC is still holding up a majority of the portfolio at about 30% and DBS at a healthy range of about 10%.

Shall wait at the sidelines to see what will happened in Dec, if there is any rate hike, before making any more purchases.

Many companies to buy, but with little cash on hand.

Moreover, last week is also seems to be a good opportunity to cash out to build up the warchest, after some good run on these 2 banks for the past recent days.

After these sell off, OCBC is still holding up a majority of the portfolio at about 30% and DBS at a healthy range of about 10%.

Shall wait at the sidelines to see what will happened in Dec, if there is any rate hike, before making any more purchases.

Many companies to buy, but with little cash on hand.

Wednesday 16 November 2016

Combo Reits Purchased!!

Been looking for a chance to get some REIT into 穷小子's portfolio, and patience has been rewarded finally. The current price may not be the lowest yet, but is a good opportunity to have a small position first. If rates hike, second purchase opportunity shall come into play.

Suntec Reit

Manage to get a comfortable 6.43% yield from yesterday. Furthermore, the price dropped from 1 month high at $1.75 to a close at $1.59 yesterday. That is a almost a 10% drop in a month. Is this a great bargain or a trap? Only time will tell.

Aim AMP Capital Industrial Reit

First time got into Industrial REIT. Not sure if this is a sunset industry, but no harm having a small position to get a 8.63%. This is one of the lowest holdings in 穷小子's portfolio.

穷小子 is trying to get a better position before the December US rates announcement. Whether hike or not, shall prepare different strategies for both scenarios.

Suntec Reit

Manage to get a comfortable 6.43% yield from yesterday. Furthermore, the price dropped from 1 month high at $1.75 to a close at $1.59 yesterday. That is a almost a 10% drop in a month. Is this a great bargain or a trap? Only time will tell.

Aim AMP Capital Industrial Reit

First time got into Industrial REIT. Not sure if this is a sunset industry, but no harm having a small position to get a 8.63%. This is one of the lowest holdings in 穷小子's portfolio.

穷小子 is trying to get a better position before the December US rates announcement. Whether hike or not, shall prepare different strategies for both scenarios.

Wednesday 9 November 2016

Trump Presidency.. What next?

穷小子 must admit this, was expecting a close fight, but didn't expect and don't wish Trump to win the campaign.

After today, guess that everyone should have know by now that any thing can happened in this world. First half of the year is Brexit, and second half is Trump. On a side note, 穷小子 vote goes to Brexit.

What next?

穷小子's guess would be America will grow stronger as promised. Mr Trump has pledged to tear up or renegotiate international trade agreements. He is going to bring the jobs back to America. The new agreements may bias towards the Americans.

In short term, we may see funds and monies will flow back to the Americans. In a longer term, we may see a stronger USD again. Strong USD means that Gold price will increase as well.

On the other hand, with a stronger America, it may seems the rest of the world will grow weaker. Not literally the rest grew weaker, but the difference will be there.

Earlier this month, analyst are expecting a 76% probability of a rate hike by year-end, but now, it may have dropped to 20% or lower. Investors have tended to favor Trump's Democratic rival Hillary Clinton as a status quo candidate who would be considered a safe pair of hands at home and on the world stage. Uncertainties doesn't favor the Fed's decision for a rate hike now.

Perhaps his victory is because of "Make America Great Again!!" Those are his words which 穷小子 had heard pretty much during his rally. The victory seems good for American but may be bad for rest of the world. The Americans have made their choice, let's respect and trust their decisions. The Americans know what is the best for them.

Hopefully can use this opportunity to buy some undervalue stocks. With the recent price drop, REITs may appears to be a safer ground if there isn't rate hike next month.

#MakeAmericaGreatAgain

After today, guess that everyone should have know by now that any thing can happened in this world. First half of the year is Brexit, and second half is Trump. On a side note, 穷小子 vote goes to Brexit.

What next?

穷小子's guess would be America will grow stronger as promised. Mr Trump has pledged to tear up or renegotiate international trade agreements. He is going to bring the jobs back to America. The new agreements may bias towards the Americans.

In short term, we may see funds and monies will flow back to the Americans. In a longer term, we may see a stronger USD again. Strong USD means that Gold price will increase as well.

On the other hand, with a stronger America, it may seems the rest of the world will grow weaker. Not literally the rest grew weaker, but the difference will be there.

Earlier this month, analyst are expecting a 76% probability of a rate hike by year-end, but now, it may have dropped to 20% or lower. Investors have tended to favor Trump's Democratic rival Hillary Clinton as a status quo candidate who would be considered a safe pair of hands at home and on the world stage. Uncertainties doesn't favor the Fed's decision for a rate hike now.

Perhaps his victory is because of "Make America Great Again!!" Those are his words which 穷小子 had heard pretty much during his rally. The victory seems good for American but may be bad for rest of the world. The Americans have made their choice, let's respect and trust their decisions. The Americans know what is the best for them.

Hopefully can use this opportunity to buy some undervalue stocks. With the recent price drop, REITs may appears to be a safer ground if there isn't rate hike next month.

#MakeAmericaGreatAgain

Thursday 3 November 2016

Small buy position for M1

Despite M1 having a bad Third Quarter results, 穷小子 bought M1 with a small position. Yes, 穷小子 did mentioned that he will not touch unless M1 hits $2 or after fourth telco announcements. But.. But.. It is too irresistible for not having a small bite to average down the overall price. Based on few points below.

- Based on today closing price, it gives a return yield of 7.42%. Assuming if the profits drops by 20%, and provided if the payout policy doesn't change, the yield will be somewhere around 5.9% . Still acceptable.

- Temasek Holdings had deemed 550K of shares at $2.101 few days ago. Temasek's deemed interests arises to 21.04% from 20.98%, via aggregation of the deemed interests held by KCL and DBSH. This boost the company's confident too.

- The volume hits 12,064,500 immediately the next trading day after the news announced. Something may be brewing.

- Pinned hope on fourth telco does not realised.

Wednesday 19 October 2016

M1 Third Quarter 2016 Results

M1 share price plunged 5.15% today, a $0.12 drop, to $2.21 today. This is much expected from the poor 3Q16 results released yesterday.

穷小子 mentioned in the previous post that M1 is having a juicy dividend yield of 6.38%, but because of fourth telco is approaching, patience prevails, and still waiting at the sidelines. Take a quick look on the 3Q2016 results.

Key Financial Highlights

穷小子 mentioned in the previous post that M1 is having a juicy dividend yield of 6.38%, but because of fourth telco is approaching, patience prevails, and still waiting at the sidelines. Take a quick look on the 3Q2016 results.

Key Financial Highlights

|

| Operating Revenue $277.6m to $249.1m, -10.3% |

|

| Cost of sales for 9 months $380.9m to $294.6m, -22.7% |

|

| Net Profit after tax $44.9m to $34.4m, -23.4% |

|

Cash & Cash equivalents, -62.9%

Net debt. 20.5%

Net debt/EBITDA, 24.8%

EPS, -12.0%

All these financial leverage are statistically bad.

|

Enough of the current statistic facts, let's see the good side of it.

As we all have known, majority of Singapore's consumers are bounded by the traditional 2 years contracts. Hence, the customer base is one of the most important factors to estimate the future, which at least how 穷小子 think.

Key Performance

Well, at least its 2 main business pillars', mobile and fixed services, base are increasing, at least at a slow pace.

Conclusion

Based on today closed price, the yield is about 6.9%, but of course, pretty much expecting a heavy cut to the dividends. Cut by how much is the big question for a dividend stock.

The management outlook are estimating a decline in FY2016 net profit after tax to be around the year-to-date range.

Assuming there will be a drop of 16% in EPS for FY2016, and the payout policy remains at 80%, we may be having a dividend of 12.8 cents for the next FY.

穷小子 is expecting few bad news to happen which can really hurt M1's share price deeply.

- News of fourth telco

- FY2016 results

- Cut in dividend

- Finally the completion of fourth telco (depending)

Hence not intending to average down in the near future. The first step which 穷小子 will be taking would be either wait for the price to hit at least $2.00 (psychological level), or after the fourth telco decision announced. Depends on whichever earlier.

As we all have known, majority of Singapore's consumers are bounded by the traditional 2 years contracts. Hence, the customer base is one of the most important factors to estimate the future, which at least how 穷小子 think.

Key Performance

|

| Mobile Customer base |

|

| Mobile Market Share |

|

| Fixed services Customer base |

Conclusion

Based on today closed price, the yield is about 6.9%, but of course, pretty much expecting a heavy cut to the dividends. Cut by how much is the big question for a dividend stock.

The management outlook are estimating a decline in FY2016 net profit after tax to be around the year-to-date range.

Assuming there will be a drop of 16% in EPS for FY2016, and the payout policy remains at 80%, we may be having a dividend of 12.8 cents for the next FY.

穷小子 is expecting few bad news to happen which can really hurt M1's share price deeply.

- News of fourth telco

- FY2016 results

- Cut in dividend

- Finally the completion of fourth telco (depending)

Hence not intending to average down in the near future. The first step which 穷小子 will be taking would be either wait for the price to hit at least $2.00 (psychological level), or after the fourth telco decision announced. Depends on whichever earlier.

Lastly, bear in mind that the worst fearful concern is that, there is still no confirmation about a fourth telco yet, there is not even a first step made by the fourth telco, but M1 profits is already dropped hard. Imagine what can this fourth telco do more hurting if it realised.

P.S. 穷小子 is not spreading fear here. M1 is about 10.9% of his total portfolio now.

P.S. 穷小子 is not spreading fear here. M1 is about 10.9% of his total portfolio now.

Tuesday 4 October 2016

What to do during this period?

What to do during this period?

Ever since the epic Brexit event, STI finally surged above 2,900 points to 2,945 unexpectedly, before coming down to 2,803 in the following month. Subsequently, it has been ranged bound between 2,800 and 2,900.

Those banks, telcos and REITs stocks in 穷小子's watchlists did not have much movements during this period as well. The announcement of delaying the rates hike in September didn't have much impact on the market at all, perhaps all are well within investors' expectations.

The price at current level is not high enough for 穷小子 to take profits, nor low enough for 穷小子 to add more positions. No dividends for September and October. Honestly speaking, this is boring, and 穷小子 did not pay much attention to the market during this period too.

All these may actually become a good time for investors to take a breath and do a review

穷小子 did the following:

After doing all these, the forecast for next year's dividend yield is pathetic, at a low range of 4%. Seems that telcos and REITs valuations could be more attractive now in order to increase the yield. Especially with M1 at a dividend yield of 6.38% on today's closing price, it could be an eye-catching.

Nonetheless, we must not forget that IDA is gonna make announcements regarding to fourth telco by the end of October, and rates hikes' decision will be made in December. These are the two major factors which will affect these two sectors respectively. Lastly, the much anticipated US President election will be around the corner as well in November.

Apart from all these, STI may continue to stagnant awhile, for at least after Chinese New Year which is Jan next year. Furthermore, the dividend seasons are pretty much over for this year.

These are all the reasons which why 穷小子 has not made his purchased yet. Patience ^^

穷小子 is almost 85% invested, hence this may be his last shot for any good bargains in the market.

Ever since the epic Brexit event, STI finally surged above 2,900 points to 2,945 unexpectedly, before coming down to 2,803 in the following month. Subsequently, it has been ranged bound between 2,800 and 2,900.

Those banks, telcos and REITs stocks in 穷小子's watchlists did not have much movements during this period as well. The announcement of delaying the rates hike in September didn't have much impact on the market at all, perhaps all are well within investors' expectations.

The price at current level is not high enough for 穷小子 to take profits, nor low enough for 穷小子 to add more positions. No dividends for September and October. Honestly speaking, this is boring, and 穷小子 did not pay much attention to the market during this period too.

All these may actually become a good time for investors to take a breath and do a review

穷小子 did the following:

- Re-valuate the valuations of those stocks in the watchlists.

- Based on the valuations, set the price alerts for each of them.

- Forecast dividend's yield and set targets for next year

After doing all these, the forecast for next year's dividend yield is pathetic, at a low range of 4%. Seems that telcos and REITs valuations could be more attractive now in order to increase the yield. Especially with M1 at a dividend yield of 6.38% on today's closing price, it could be an eye-catching.

Nonetheless, we must not forget that IDA is gonna make announcements regarding to fourth telco by the end of October, and rates hikes' decision will be made in December. These are the two major factors which will affect these two sectors respectively. Lastly, the much anticipated US President election will be around the corner as well in November.

Apart from all these, STI may continue to stagnant awhile, for at least after Chinese New Year which is Jan next year. Furthermore, the dividend seasons are pretty much over for this year.

These are all the reasons which why 穷小子 has not made his purchased yet. Patience ^^

穷小子 is almost 85% invested, hence this may be his last shot for any good bargains in the market.

Thursday 22 September 2016

穷小子 Style

What is 穷小子 style? Is very simple. Living with a frugal lifestyle in a materialistic society and aiming to achieve financial freedom for the future.

There is a thin line between 穷小子 Style and being stingy style by his definitions. 穷小子 would spend and pay only for what he think is worth, but a stingy guy doesn't even have this traits at the minimum.

Try to maintain a $4 per meal for weekdays (working days). Which these are almost being covered by the current passive income.

Better still. Sometimes only spend $2.20 on Zhar Cai Peng (mixed vegetables rice), with only one meat and one vegetables. Don't worry, 穷小子 is not torturing himself, he is just a person who can finish only a bowl of purely white rice only.

Doesn't go foodcourt.

In 穷小子's opinion, food in foodcourt doesn't taste take good, it is often over-priced. Still prefer the hawket centre and those authenticate market style type.

Doesn't buy drinks when having his meal.

Doesn't buy coffee or tea, only takes self-made 3-in-1.

Can have have a Cadbury hot chocolate from the many choices.

Seldom buys new clothes, accessories, or shoes.

Prefer to choose walk if it is only a two bus stops distance, or sometimes even three, depending on the actual distance.

Walking is a good form of exercise.

Doesn't take cab when travelling alone even though it may took more than an hour via public transport.

Unless it is an emergency case.

Doesn't eat over-priced ice-cream.

He will be just as contended with only a $1.50 hot fudge ice-cream from McDonald's.

Didn't sign up for any Gym membership.

Still don't understand why is there a need for signing up a Gym membership. With or without gym, the process of exercise would still the same, except perhaps that there might be peer pressures when in a Gym. He do have a set of dumbbell at home, and can do almost various types of Gym-type level of exercise in a community fitness corner and parks.

Doesn't watch movies in a cinema. Especially doesn't purchased the popcorn set even if he visits one.

Most of the shows can be watched via online in nowadays.

********************************************************************************************************************

Now let's talk about the opposites sides.

穷小子 has at least a good meal in almost every weekend at a restaurant with his loves ones or family.

Spending average of around $30-$50, or even more sometimes when there is an occasion to celebrates.

穷小子 loves to eat.

Doesn't go to foodcourt but once in a while, will spent over hundred for a sumptuous meal, especially an International Buffet style to pamper himself.

穷小子 in fact loves plain water actually.

If there is a need, he can always go to a supermarket nearby to buy a drink which is way much cheaper than those from foodcourts' or hawker's (with the same types of drinks). NTUC is everywhere to be seen in nowadays.

穷小子 will go for a tea breaks at a cafe too.

Enjoy Starbucks or Coffee Bean once a fortnight averagely.

穷小子 only wears normal brands of clothing such as H&M, Aeropostale, Uniqlo.

Most of them are bought during the sale. Great Singapore Sale!!

穷小子 doesn't mind to pay for cab when there is/are companions.

Mainly because he has the mindset of that why not fully utilized the empty seats if he is commuting one. Doesn't mind to foot the bill too.

穷小子 will visits Cold Stone once in a blue moon.

Expensive? Yes. Worth it? Yes too.

穷小子 got a Safra membership at least for the exercise activities.

Willing to pay for a marathon event as well on top of that.

穷小子 willing to buy tickets of a blockbusters movies only.

He loves Marvel especially. Not only to watch them in a cinema, but purchased Atmos, 3D, etc. Have not tried GV Gold Class yet.

If you have for about more than 75% of those mentioned traits. Congratulations!! Welcome to 穷小子's style.

These are of course the few traits which came across his mind for now, perhaps shall update more to this along the way.

穷小子 used to splurge and spent lavishly on his drinking sessions, parties, gambles and on the branded during his younger days. Perhaps because he is in his the early 30s now, and have been through all these stages of life already, his mindsets and directions have changed.

Whether you see if 穷小子 is stingy or not, is up to one's perceptions. To him, it doesn't matters. Living with freedom and happiness, and a healthy with loves ones, is all that does matters right now. This is his belief after all.

There is a thin line between 穷小子 Style and being stingy style by his definitions. 穷小子 would spend and pay only for what he think is worth, but a stingy guy doesn't even have this traits at the minimum.

Try to maintain a $4 per meal for weekdays (working days). Which these are almost being covered by the current passive income.

Better still. Sometimes only spend $2.20 on Zhar Cai Peng (mixed vegetables rice), with only one meat and one vegetables. Don't worry, 穷小子 is not torturing himself, he is just a person who can finish only a bowl of purely white rice only.

Doesn't go foodcourt.

In 穷小子's opinion, food in foodcourt doesn't taste take good, it is often over-priced. Still prefer the hawket centre and those authenticate market style type.

Doesn't buy drinks when having his meal.

Doesn't buy coffee or tea, only takes self-made 3-in-1.

Can have have a Cadbury hot chocolate from the many choices.

Seldom buys new clothes, accessories, or shoes.

Prefer to choose walk if it is only a two bus stops distance, or sometimes even three, depending on the actual distance.

Walking is a good form of exercise.

Doesn't take cab when travelling alone even though it may took more than an hour via public transport.

Unless it is an emergency case.

Doesn't eat over-priced ice-cream.

He will be just as contended with only a $1.50 hot fudge ice-cream from McDonald's.

Didn't sign up for any Gym membership.

Still don't understand why is there a need for signing up a Gym membership. With or without gym, the process of exercise would still the same, except perhaps that there might be peer pressures when in a Gym. He do have a set of dumbbell at home, and can do almost various types of Gym-type level of exercise in a community fitness corner and parks.

Doesn't watch movies in a cinema. Especially doesn't purchased the popcorn set even if he visits one.

Most of the shows can be watched via online in nowadays.

********************************************************************************************************************

Now let's talk about the opposites sides.

穷小子 has at least a good meal in almost every weekend at a restaurant with his loves ones or family.

Spending average of around $30-$50, or even more sometimes when there is an occasion to celebrates.

穷小子 loves to eat.

Doesn't go to foodcourt but once in a while, will spent over hundred for a sumptuous meal, especially an International Buffet style to pamper himself.

穷小子 in fact loves plain water actually.

If there is a need, he can always go to a supermarket nearby to buy a drink which is way much cheaper than those from foodcourts' or hawker's (with the same types of drinks). NTUC is everywhere to be seen in nowadays.

穷小子 will go for a tea breaks at a cafe too.

Enjoy Starbucks or Coffee Bean once a fortnight averagely.

穷小子 only wears normal brands of clothing such as H&M, Aeropostale, Uniqlo.

Most of them are bought during the sale. Great Singapore Sale!!

穷小子 doesn't mind to pay for cab when there is/are companions.

Mainly because he has the mindset of that why not fully utilized the empty seats if he is commuting one. Doesn't mind to foot the bill too.

穷小子 will visits Cold Stone once in a blue moon.

Expensive? Yes. Worth it? Yes too.

穷小子 got a Safra membership at least for the exercise activities.

Willing to pay for a marathon event as well on top of that.

穷小子 willing to buy tickets of a blockbusters movies only.

He loves Marvel especially. Not only to watch them in a cinema, but purchased Atmos, 3D, etc. Have not tried GV Gold Class yet.

If you have for about more than 75% of those mentioned traits. Congratulations!! Welcome to 穷小子's style.

These are of course the few traits which came across his mind for now, perhaps shall update more to this along the way.

Money is important, but to live life to its fullest is equally important as well. Do not sacrifice your friendships or families bonding time if is just for the sake of saving the money.

The chances of these bonding will gets slimmer as times flies, especially when most of your friends starts to have each of their own families. Although these friendships and kinship are still close, you will not be able to meet up with them that much as before, and oftenly with due to each one's commitments. An experience from 穷小子. Remember, You Only Live Once. #YOLO

Whether you see if 穷小子 is stingy or not, is up to one's perceptions. To him, it doesn't matters. Living with freedom and happiness, and a healthy with loves ones, is all that does matters right now. This is his belief after all.

Monday 12 September 2016

Portfolio Update: CapitaLand Commercial Trust (CCT)

Have just reduced about 40% of CapitaLand Commercial Trust (CCT) holdings from the portfolio last week. Is not that 穷小子 had lost his confidence in the company, but is more due to re-balance the portfolio.

CapitaLand Commercial Trust (CCT) had a good run for the past 3 months, from $1.385 to $1.64, which gives about 18.4% return. A 18.4% profits is roughly about 3-years worth of dividends. By looking from another angle, the dividend yield drops from 6.28% to 5.3%. 穷小子 feels that there may be a profit taking session for those short term holders on this counter in the near term after such a run. Moreover, coming up would be Fed's decisions on the rate hikes and of course the US President election.

With all these reasons, 穷小子 used this opportunity to build up his war chest instead.

There is still 60% of CCT sits in 穷小子's portfolio and no doubt adding REITS into the portfolio is still one of this year's resolution,

CapitaLand Commercial Trust (CCT) had a good run for the past 3 months, from $1.385 to $1.64, which gives about 18.4% return. A 18.4% profits is roughly about 3-years worth of dividends. By looking from another angle, the dividend yield drops from 6.28% to 5.3%. 穷小子 feels that there may be a profit taking session for those short term holders on this counter in the near term after such a run. Moreover, coming up would be Fed's decisions on the rate hikes and of course the US President election.

With all these reasons, 穷小子 used this opportunity to build up his war chest instead.

There is still 60% of CCT sits in 穷小子's portfolio and no doubt adding REITS into the portfolio is still one of this year's resolution,

|

| CapitaLand Commercial Trust (CCT) |

Wednesday 31 August 2016

Poorlearnrich's portfolio update

The month of July and August, the second half of dividend collection! Let's have a portfolio update.

穷小子's portfolio update:

For the period of these two months, 穷小子 will be receiving a total of S$1,755.55 in dividends.

Dividends received this round: S$1,755.55

Year 2016

Total dividends: S$3,552.70

Average dividends per month: S$444.09

Average dividends per day: S$14.56

穷小子 still trying hard to increase his dividend yield for his portfolio. Although did mention that was trying to get REITS in his portfolio, still didn't manage to do so. FCT did have a sudden drop at June, but didn't notice that that day, and it recovers fast and furious subsequently. Maybe will have a chance again when rate hikes. Anyway, got FCL instead.

Been 3 weeks since the last post due to Pokemon fever. Hehe~

穷小子's portfolio update:

For the period of these two months, 穷小子 will be receiving a total of S$1,755.55 in dividends.

Dividends received this round: S$1,755.55

Year 2016

Total dividends: S$3,552.70

Average dividends per month: S$444.09

Average dividends per day: S$14.56

穷小子 still trying hard to increase his dividend yield for his portfolio. Although did mention that was trying to get REITS in his portfolio, still didn't manage to do so. FCT did have a sudden drop at June, but didn't notice that that day, and it recovers fast and furious subsequently. Maybe will have a chance again when rate hikes. Anyway, got FCL instead.

Been 3 weeks since the last post due to Pokemon fever. Hehe~

Wednesday 3 August 2016

OCBC 2Q2016 Financial Results

To be a better value investor, first of all, should at least know how to analyst a financial results.

As mentioned in all the previous posts, 穷小子 admitted that he is not a great Financial Analyst. Decided to do a simple analyst and shall use OCBC's first half of the year results for a start, since OCBC took up a majority of 穷小子's portfolio. Please advise/correct him there is any misinformation. Thanks.

Believed that most of the broker's research reports and fellow bloggers should have covered pretty much already. Hence, shall not covers too much about the details, but only touch on the areas which 穷小子 is more concern about instead.

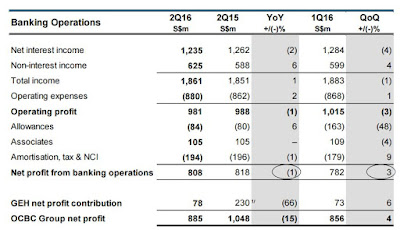

News headlines would says "Net profit of S$885m was 15% lower YoY; but 4% higher QoQ". Most of the news says it is drag down by its insurance arm, Great Easter's earnings. Actually why is it so? Is it good or bad? 穷小子 do not have a definite answer for now, perhaps need to wait for the annual report to see if there is any improvement before suggesting further.

Next is we need to know how much is OCBC's insurance arm's weightage.

Next up to the concern in trend would be the Oil and Gas exposure.

Total exposure to Oil and Gas is S$14.3b, and out of which, the customer loans is only at 6%. If 穷小子 remember correctly, the CEO did says that this is negligible during the last AGM. At least there is no exposure to Swiber.

If only to put UK into account, it is only about 2.2% of total assets, which is negligible as well.

Was expecting to have a better payout ratio of at least 40% and a higher dividend at about $0.37-$0.38 for last year, but too bad. Well, at least they did increase the payout ratio for this time round, and didn't cut the dividend. Give and take for this.

Another disappointing factor is that there is no scrip dividend for this time round, although did mentioned that this is up to the management decision.

Assuming based on today's XD closing price at $8.35, a rough calculation would means that the scrip price should be at least below the current book value. 穷小子 always loves the scrip dividend when the price is low.

Conclusion

It seems that only Great Eastern's profits contribution is the only one which signal the minor red flag here. Both Oil & Gas and Brexit concerns can be negligible. No changes to the strategy, will continue to hold this for a very long term, and in fact, looking at an opportunity to buy when the price is 0.90x of the book value.

As mentioned in all the previous posts, 穷小子 admitted that he is not a great Financial Analyst. Decided to do a simple analyst and shall use OCBC's first half of the year results for a start, since OCBC took up a majority of 穷小子's portfolio. Please advise/correct him there is any misinformation. Thanks.

Believed that most of the broker's research reports and fellow bloggers should have covered pretty much already. Hence, shall not covers too much about the details, but only touch on the areas which 穷小子 is more concern about instead.

News headlines would says "Net profit of S$885m was 15% lower YoY; but 4% higher QoQ". Most of the news says it is drag down by its insurance arm, Great Easter's earnings. Actually why is it so? Is it good or bad? 穷小子 do not have a definite answer for now, perhaps need to wait for the annual report to see if there is any improvement before suggesting further.

|

| We can see that there is a great drop of 66% in Great Eastern profits contribution from last year. Shall not covers more about why Great Eastern profits drop since the concern here is about OCBC. |

Next is we need to know how much is OCBC's insurance arm's weightage.

|

| Insurance's weight at about 11% |

To 穷小子's simplest way of understand is that 11% of OCBC value will be totally wiped off if only there is a worst case scenario for Great Eastern. Guess that OCBC should be able to survive it, but of course, we are still far from seeing this to happen.

Next up to the concern in trend would be the Oil and Gas exposure.

|

| 6% of total customer loans |

Coming up next will be the exposure to the Brexit effects.

|

| Less than 3% of total assets |

Last but not least, let's look into the what 穷小子 interest in most, the dividend payout.

|

| Maintained dividend of $0.18 per share |

Another disappointing factor is that there is no scrip dividend for this time round, although did mentioned that this is up to the management decision.

Assuming based on today's XD closing price at $8.35, a rough calculation would means that the scrip price should be at least below the current book value. 穷小子 always loves the scrip dividend when the price is low.

Conclusion

It seems that only Great Eastern's profits contribution is the only one which signal the minor red flag here. Both Oil & Gas and Brexit concerns can be negligible. No changes to the strategy, will continue to hold this for a very long term, and in fact, looking at an opportunity to buy when the price is 0.90x of the book value.

Saturday 30 July 2016

Last week for Stanchart Trading

Have you prepared enough for the Stanchart Trading minimum commission begins on 01 Aug 2016.

穷小子 had done these approaches. Cut the short term and build the long term. In fact, most of them are cut on the next day after the announcement.

Sold small position with contract value ≤ $3,500 and less than 1,000 of shares,

Frasers Centrepoint Limited (TQ5) *got it back, and is in CDP currently*

ARA Asset Management (D1R)

Sheng Shiong (OV8)

Hold those stocks which are planned for mid-term,

STI ETF (ES3) *sold it already due to the recent great run*

Build those with higher contract value and

more than 1,000 shares and are planned to hold for long term,

DBS (D05)

Singtel (Z74)

These two and together with CapitaComm Trust (C61U) will be transferred over to CDP

Bye Stanchart Trading

穷小子 had done these approaches. Cut the short term and build the long term. In fact, most of them are cut on the next day after the announcement.

Sold small position with contract value ≤ $3,500 and less than 1,000 of shares,

Frasers Centrepoint Limited (TQ5) *got it back, and is in CDP currently*

ARA Asset Management (D1R)

Sheng Shiong (OV8)

Hold those stocks which are planned for mid-term,

STI ETF (ES3) *sold it already due to the recent great run*

Build those with higher contract value and

more than 1,000 shares and are planned to hold for long term,

DBS (D05)

Singtel (Z74)

These two and together with CapitaComm Trust (C61U) will be transferred over to CDP

Bye Stanchart Trading

Wednesday 20 July 2016

Portfolio Update: Purchased Frasers Centrepoint Limited

Since after almost 2 months from the last post about my observations on Waterway Point, 穷小子 finally managed to get a small position today.

The current book value is about $2.66. With based on today closing price of $1.52, I am quite comfortable with the 0.57 of the book value.

As mentioned in the previous post, there are 2 minor concerns which need to be considered before making the buy call. Low liquidity and High Debt.

Low liquidity

The low liquidity is not much of a concern to me. Having an intention to hold it for long-term, and since is a small position only, quite confident that I will be able to sell it at my target price in the far future.

High Debt

Based on the latest quarter report, the Net Debt/Equity is 87.5%, an increased from the previous quarter of 83.8%. 穷小子 is not that good in his fundamental analysis, but this seems to be a minor red flag. Looking forward to see a lower ratio in the next report with the recent IPO of Frasers Logistics & Industrial. Of course this shouldn't be the only measurement to gauge a company, will check on their upcoming report and keep track of it.

On the side track, notice that the 2-year low price is actually at $1.40 only. Did a simple maths calculations.

If the price really came down to this price (*touch wood*), it will be a 7.9% drop. With today closing price at $1.52, it will have a dividend yield of 5.66%. Hence, 2 years of dividend will be sufficient to cover it.

This purchased is about 4.5% of 穷小子's total portfolio only. Shall understand further on the upcoming report before adding any new positions.

The current book value is about $2.66. With based on today closing price of $1.52, I am quite comfortable with the 0.57 of the book value.

As mentioned in the previous post, there are 2 minor concerns which need to be considered before making the buy call. Low liquidity and High Debt.

Low liquidity

The low liquidity is not much of a concern to me. Having an intention to hold it for long-term, and since is a small position only, quite confident that I will be able to sell it at my target price in the far future.

High Debt

Based on the latest quarter report, the Net Debt/Equity is 87.5%, an increased from the previous quarter of 83.8%. 穷小子 is not that good in his fundamental analysis, but this seems to be a minor red flag. Looking forward to see a lower ratio in the next report with the recent IPO of Frasers Logistics & Industrial. Of course this shouldn't be the only measurement to gauge a company, will check on their upcoming report and keep track of it.

On the side track, notice that the 2-year low price is actually at $1.40 only. Did a simple maths calculations.

If the price really came down to this price (*touch wood*), it will be a 7.9% drop. With today closing price at $1.52, it will have a dividend yield of 5.66%. Hence, 2 years of dividend will be sufficient to cover it.

This purchased is about 4.5% of 穷小子's total portfolio only. Shall understand further on the upcoming report before adding any new positions.

|

| Not to confused, its with the symbol TQ5 |

Monday 18 July 2016

Breadtalk $1 promotion

|

| Starting 12:16pm daily from 14th to 21st July. |

穷小子 used to be a fan of Breadtalk too, but had "boycott" it at least 3 years ago, since when the price keep increasing annually. But everything changed for this week (only).

Let's sees what had 穷小子 noticed about this promotion.

- It seems like every outlets are flooded with long queue for the past 4 days. Okie, maybe 穷小子 is a little over exaggerated, but even if is not every outlets, it is at least for these 4 outlets for sure which 穷小子 had visited, Toa Payoh, Yishun, Plaza Singapura and Vivocity.

- The promotion started at 12:16pm, but the long queue had started building up from 12 noon onwards. Seems there are many customers are like 穷小子, hungry for it, but had to "boycott" it due to its price.

- Once the bell hits 12:16pm, the cashiers and staffs start to clear the queue fast and efficiently. Wondering how much sales did this promotion had contributed.

- Despite having to say limited quantities for each outlets, Breadtalk has been generous about this promotion. Can see that trays and trays of breads are coming out from their kitchen during the peak hours without delay, and its staffs are encouraging the customers to get as much as they like. 穷小子 has not seen the promotion being sold out for the past 4 nights so far.

- They are using a sell less but many method. By selling at a cheaper price, it managed to get hold of a larger pool of market crowd.

After its insensitive marketing tactic by selling our Ah Gong commemorative bun and the infamous Soya Bean Saga last year, can Breadtalk finally pull off a positive news headlines this year?

A gentle reminder, although it is at $1 only, please do not over purchased it. 穷小子 had bought 12 pieces in 3 days. Had to stop for now, else it became spending more instead of saving more.

This post may have came late, so, every one please enjoy the promotions before the deals ends.

穷小子's post is not and have no intentions of doing any advertisement for or against Breadtalk.

After 21 Jul, 穷小子 gonna resume "boycott" again. ^^

Thursday 14 July 2016

NAV vs Market Value

What is Net Asset Value (NAV)

In layman's term NAV means how much a stock would have "worth", which is calculated by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding

What is Market Value

In layman's term Market Value is the value of a company according to the stock market. Buyers and sellers used this price to buy and sell stock at a stock exchange.

Illustration

Stock A

An ice-cream with NAV of $0.50 per scoop selling at $5.00 per scoop to its customers

Stock B

A packet of chicken rice with NAV of $3.00 selling at $3.50 per packet to its customers.

Analogy

Often it would have been the case which we had seen, the newly opened ice-cream shop in town will have a much longer queue than a traditional chicken rice stall. The ice-cream are obviously over-priced and tasted normal or just slightly better than average but the customers willing to pay extra for a try, and also of course of the long queue syndrome. The ice cream price goes up along with its popularity.

A year later, the ice cream customers would have then realised that they had actually paid 10 times more for a normal ice cream. The customer would eventually went back to buy chicken rice for their daily lunch or dinner, which are only 1.17 times more than its value, and the ice cream stall would eventually closed down.

Stock Market

Stock A is a new hot IPO in town, with the price-to-net-asset-value (P/NAV) ratio of 10, or some called it Price / Book Value. Stock B have a P/NAV of 1.17 only.

Based on the P/NAV only, ignoring other factor, Stock B would be a better choice for long term investing.

Often, Stock A's price would goes up during the early stage due to the fact that many would rush to and grab a bite, and some would take this newly IPO stock in town for a try, hoping that it can be a multi-baggers stock. Most of the cases, the trend and popularity dies off eventually, Stock A daily volume drops, and people will turn back to Stock B, a good old dividend stock.

Another example is if we would take a look at our three largest local bank.

NAV, estimated based on Yahoo finance

DBS - $16.72, P/NAV at 0.95x

OCBC - $8.57, P/NAV at 1.03x

UOB - $19.06, P/NAV at 0.97x

Market Value, based on today closed price

DBS - $15.95

OCBC - $8.86

UOB - $18.62

Which is cheaper?

DBS which has the lowest NAV or OCBC with the lowest Market Value?

Which is more expensive?

OCBC which has the highest NAV, or UOB with the highest Market Value?

What's your take?

Want to get a taste of the new ice cream in town which everybody are rushing to queue, or choose to take a boring chicken rice for your daily meals.

In layman's term NAV means how much a stock would have "worth", which is calculated by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding

What is Market Value

In layman's term Market Value is the value of a company according to the stock market. Buyers and sellers used this price to buy and sell stock at a stock exchange.

Illustration

Stock A

An ice-cream with NAV of $0.50 per scoop selling at $5.00 per scoop to its customers

Stock B

A packet of chicken rice with NAV of $3.00 selling at $3.50 per packet to its customers.

Analogy

Often it would have been the case which we had seen, the newly opened ice-cream shop in town will have a much longer queue than a traditional chicken rice stall. The ice-cream are obviously over-priced and tasted normal or just slightly better than average but the customers willing to pay extra for a try, and also of course of the long queue syndrome. The ice cream price goes up along with its popularity.

A year later, the ice cream customers would have then realised that they had actually paid 10 times more for a normal ice cream. The customer would eventually went back to buy chicken rice for their daily lunch or dinner, which are only 1.17 times more than its value, and the ice cream stall would eventually closed down.

Stock Market

Stock A is a new hot IPO in town, with the price-to-net-asset-value (P/NAV) ratio of 10, or some called it Price / Book Value. Stock B have a P/NAV of 1.17 only.

Based on the P/NAV only, ignoring other factor, Stock B would be a better choice for long term investing.

Often, Stock A's price would goes up during the early stage due to the fact that many would rush to and grab a bite, and some would take this newly IPO stock in town for a try, hoping that it can be a multi-baggers stock. Most of the cases, the trend and popularity dies off eventually, Stock A daily volume drops, and people will turn back to Stock B, a good old dividend stock.

Another example is if we would take a look at our three largest local bank.

NAV, estimated based on Yahoo finance

DBS - $16.72, P/NAV at 0.95x

OCBC - $8.57, P/NAV at 1.03x

UOB - $19.06, P/NAV at 0.97x

Market Value, based on today closed price

DBS - $15.95

OCBC - $8.86

UOB - $18.62

Which is cheaper?

DBS which has the lowest NAV or OCBC with the lowest Market Value?

Which is more expensive?

OCBC which has the highest NAV, or UOB with the highest Market Value?

What's your take?

Want to get a taste of the new ice cream in town which everybody are rushing to queue, or choose to take a boring chicken rice for your daily meals.

Thursday 7 July 2016

Was it a right choice to sold off Noble?

A recapped, about a month after the sold off, and about a week after it XR. Have sold off Noble shares on 03 Jun 2016. Let's see whether did 穷小子 had made the right choices so far.

From the price at $0.26 on 03 Jun 2016, to the closed price at $0.215 on 27 Jun 2016 (the day before XR). It is about a drop of 17.3%.

Based on the formula, and with the rights issued price of $0.11, the theoretical price should be $0.1625. Due to whatever the reasons, it closed at $0.18 on the 28 Jun 2016 (the XR date) which is higher than the theoretical price.

The mother share closed at $0.184 today, 07 July, and with Noble R share closed at 0.074.

穷小子 sold his 3,000 shares on 03 Jun, the value is about $780.

If 穷小子 had hold his shares until now, and with the exercise of the rights shares:

The total value for the 6,000 shares will be valued at $1,104 based on the today's closed price at $0.184, and not forgetting to deduct $330 from this for the purchasing of the rights shares, which gives about $774.

Okie, no much difference in value, only $6. The few hundreds actually makes no much differences from the 88% lost anyway.

As mentioned in the previous post, it is not the dollar which made the sell call, but is more on the trust and confidence in this company.

With the sudden departure of the CEO's and its founder, it's just doesn't feel comfortable with purchasing the rights, and especially with the reason of having the company's intention to used it for repaying the debts. All these doesn't sum up as a good choice.

Not mentioning about the Minimum Trade Price rules, how will Noble tackle it? From the way 穷小子 sees it is either do a share consolidation or delist it from SGX, unless the managing board have new tricks under their sleeves.

It may continue its downwards trend from where it is currently. This shall be the last post regarding to Noble. Have decided to remove this from my watchlist. I don't see the point of keeping track of this any further, unless its fundamentals have changed.

On the side track, 穷小子 managed to have some profits from the Euro. Hehe.

From the price at $0.26 on 03 Jun 2016, to the closed price at $0.215 on 27 Jun 2016 (the day before XR). It is about a drop of 17.3%.

Based on the formula, and with the rights issued price of $0.11, the theoretical price should be $0.1625. Due to whatever the reasons, it closed at $0.18 on the 28 Jun 2016 (the XR date) which is higher than the theoretical price.

The mother share closed at $0.184 today, 07 July, and with Noble R share closed at 0.074.

穷小子 sold his 3,000 shares on 03 Jun, the value is about $780.

If 穷小子 had hold his shares until now, and with the exercise of the rights shares:

The total value for the 6,000 shares will be valued at $1,104 based on the today's closed price at $0.184, and not forgetting to deduct $330 from this for the purchasing of the rights shares, which gives about $774.

Okie, no much difference in value, only $6. The few hundreds actually makes no much differences from the 88% lost anyway.

As mentioned in the previous post, it is not the dollar which made the sell call, but is more on the trust and confidence in this company.

With the sudden departure of the CEO's and its founder, it's just doesn't feel comfortable with purchasing the rights, and especially with the reason of having the company's intention to used it for repaying the debts. All these doesn't sum up as a good choice.

Not mentioning about the Minimum Trade Price rules, how will Noble tackle it? From the way 穷小子 sees it is either do a share consolidation or delist it from SGX, unless the managing board have new tricks under their sleeves.

It may continue its downwards trend from where it is currently. This shall be the last post regarding to Noble. Have decided to remove this from my watchlist. I don't see the point of keeping track of this any further, unless its fundamentals have changed.

On the side track, 穷小子 managed to have some profits from the Euro. Hehe.

Friday 1 July 2016

穷小子's mid-year accomplishment

We are already half way through 2016. What has 穷小子 accomplished?

Started a blog

Of course the first will be starting a new blog, this blog. ^^

Attended first Annual General Meeting

穷小子 has successfully attended his first AGM. This was the first AGM ever attended although started buying shares since 2009. Slightly more than 30% of the portfolio is OCBC, hence made the decision to take a day leave to attend OCBC AGM this year. I must say, it is really an eye-opener. The CEO and board of directors presented themselves well. A lot seniors citizen, so my guess is that they may be the long time loyal investors which the CEO himself had also mentioned. Do not judge a book by its cover I must say, the investors who attended are with different appearances, attire, age groups and from all walks of life. Of course, not forget to mention about the infamous food queue, what a sight. Will be attending more for the upcoming year and try to do few write up about them.

Finished reading a book

穷小子 don't like to read books. Managed to finish up One Up on Wall Street is a good start at least. Wouldn't elaborate more about this, as the review is here. Have another good read on a book next year? Let's try.

Beating the STI

穷小子 must admit this. He had never managed to beat STI for the past few years. Beating the STI shall be his small steps to start with.

As of the last day of Jun, STI is +0.174% for the past 6 months. STI ETF is -0.69%.

If based on those stocks which purchased on 2016 YTD, is +8.575%.

If based on existing portfolio is approximately +3.413%.

Despite the Brexit recently, my portfolio managed to beat the STI at least, target achieved. This will be a benchmark for my humble target for now.

Cleared his IPPT

Managed to get Silver for the new IPPT system. $300 incentives. Translate it into dividends, it will be a year's worth of dividend if you owns 500 of DBS shares. Only every Singapore's son will understand this, the sufferings and rewards in it.

Achieving a passive income

Actually do not have a feasible target for this at the moment. Up to date, achieving at about $11 per day. Perhaps after this year shall see how much it can grows, and shall set a realistic target at end of this year.

Let it Grow! Let it Grow!

Poor Learn Rich (穷小子日记)

Started a blog

Of course the first will be starting a new blog, this blog. ^^

Attended first Annual General Meeting

穷小子 has successfully attended his first AGM. This was the first AGM ever attended although started buying shares since 2009. Slightly more than 30% of the portfolio is OCBC, hence made the decision to take a day leave to attend OCBC AGM this year. I must say, it is really an eye-opener. The CEO and board of directors presented themselves well. A lot seniors citizen, so my guess is that they may be the long time loyal investors which the CEO himself had also mentioned. Do not judge a book by its cover I must say, the investors who attended are with different appearances, attire, age groups and from all walks of life. Of course, not forget to mention about the infamous food queue, what a sight. Will be attending more for the upcoming year and try to do few write up about them.

Finished reading a book

穷小子 don't like to read books. Managed to finish up One Up on Wall Street is a good start at least. Wouldn't elaborate more about this, as the review is here. Have another good read on a book next year? Let's try.

Beating the STI

穷小子 must admit this. He had never managed to beat STI for the past few years. Beating the STI shall be his small steps to start with.

As of the last day of Jun, STI is +0.174% for the past 6 months. STI ETF is -0.69%.

If based on those stocks which purchased on 2016 YTD, is +8.575%.

If based on existing portfolio is approximately +3.413%.

Despite the Brexit recently, my portfolio managed to beat the STI at least, target achieved. This will be a benchmark for my humble target for now.

Cleared his IPPT

Managed to get Silver for the new IPPT system. $300 incentives. Translate it into dividends, it will be a year's worth of dividend if you owns 500 of DBS shares. Only every Singapore's son will understand this, the sufferings and rewards in it.

Achieving a passive income

Actually do not have a feasible target for this at the moment. Up to date, achieving at about $11 per day. Perhaps after this year shall see how much it can grows, and shall set a realistic target at end of this year.

Let it Grow! Let it Grow!

Poor Learn Rich (穷小子日记)

Friday 24 June 2016

Poor Learn Rich (穷小子日记) has reached 10,000 views!!

穷小子日记 has reached 10,000 views. 穷小子 started his blog on 25 Apr, so it took exactly about 2 months to hit 10,000 views.

This is much thanks to thefinance.sg and sginvestbloggers for sharing 穷小子日记 for the past 2 months.

OCBC Scrip Dividend Scheme holds the highest of views record so far. Of course, the next will be Standard Chartered trading: No "No Minimum Commission" which is recommended by dollarsandsense.sg and this was subsequently shared by sg.finance.yahoo.com as well.

What an experience during past 2 months. All in all, thanks all the viewers for the support.

穷小子 will continue to share his investment experiences and observance.

Poor Learn Rich (穷小子日记)

This is much thanks to thefinance.sg and sginvestbloggers for sharing 穷小子日记 for the past 2 months.

OCBC Scrip Dividend Scheme holds the highest of views record so far. Of course, the next will be Standard Chartered trading: No "No Minimum Commission" which is recommended by dollarsandsense.sg and this was subsequently shared by sg.finance.yahoo.com as well.

What an experience during past 2 months. All in all, thanks all the viewers for the support.

穷小子 will continue to share his investment experiences and observance.

Poor Learn Rich (穷小子日记)

Wednesday 22 June 2016

One Up on Wall Street By Peter Lynch

穷小子 has finished the book early of this year. For those who have not heard of him, he is one of the greatest investors of all time. When Peter Lynch is the manager of the Magellan Fund at Fidelity Investments, he averaged a 29.2% annual return, consistently more than doubling the S&P 500 market index and making it the best performing mutual fund in the world. The assets under management increased from $18 million to $14 billion during his tenure. Lynch is consistently described as a "legend" by the financial media for his performance record, and was called legendary" by Jason Zweig in his 2003 update of Benjamin Graham's book, The Intelligent Investor. More of this bios can be read here.

Why is 穷小子 recommends this book? Reason is simple, because it is easy to understand. 穷小子 does not have much of finance background to begin with. If he can understands it, and so can you. Main take away from this book for 穷小子 is that, observe the environment, observe on what is happening in your surroundings. The next most "in" stock may just be around the corner in your neighbourhood.

Starbucks is one of the good examples to relate in this. Every where and every when 穷小子 goes, Starbucks seems to be full house forever, or almost as to say. This has always been much on the scene we had seen when the first Starbucks store came to Singapore in 1996.

How does Starbucks performed throughout all these year?

A simple answer tells it all. If one had bought 1,000 during its IPO in 1992, the value is estimated to be at $302,048 after its sixth splits in 2015. On a side track, an interesting calculator from Starbucks website for all these calculations to share.

1) The Slow Growers

2) The Stalwarts

3) The Fast Growers

4) The Cyclicals

5) Turnarounds

6) The Asset Plays

Bottom line is that 穷小子 is not suggesting that Peter lynch is not good in his financial analysis, and hence his stock pick is by observing only. Of course much is still needs to be done after that. By observing is just the first step to identify a rare gem.

This method is useful and applies significantly to 穷小子. He doesn't not has much of financial fundamentals in it, observing the surroundings may just be a good start for him, and together with his basic-reading skills in financial reports reading.

Few of his famous quotes:

Why is 穷小子 recommends this book? Reason is simple, because it is easy to understand. 穷小子 does not have much of finance background to begin with. If he can understands it, and so can you. Main take away from this book for 穷小子 is that, observe the environment, observe on what is happening in your surroundings. The next most "in" stock may just be around the corner in your neighbourhood.

Starbucks is one of the good examples to relate in this. Every where and every when 穷小子 goes, Starbucks seems to be full house forever, or almost as to say. This has always been much on the scene we had seen when the first Starbucks store came to Singapore in 1996.

How does Starbucks performed throughout all these year?

A simple answer tells it all. If one had bought 1,000 during its IPO in 1992, the value is estimated to be at $302,048 after its sixth splits in 2015. On a side track, an interesting calculator from Starbucks website for all these calculations to share.

穷小子 is not suggesting that Starbucks will be around here forever, but it is a good example to illustrate at least until today.

Of course, not forgetting the six types of stocks which Peter Lynch had identified.

1) The Slow Growers

2) The Stalwarts

3) The Fast Growers

4) The Cyclicals

5) Turnarounds

6) The Asset Plays

This method is useful and applies significantly to 穷小子. He doesn't not has much of financial fundamentals in it, observing the surroundings may just be a good start for him, and together with his basic-reading skills in financial reports reading.

Few of his famous quotes:

- "Invest in what you know and why you own it."

- "Go for a business that any idiot can run – because sooner or later, any idiot is probably going to run it."

- "If you stay half-alert, you can pick the spectacular performers right from your place of business or out of the neighborhood shopping mall, and long before Wall Street discovers them."

- "Investing without research is like playing stud poker and never looking at the cards."

- "Absent a lot of surprises, stocks are relatively predictable over twenty years. As to whether they're going to be higher or lower in two to three years, you might as well flip a coin to decide."

- "If you spend more than 13 minutes analyzing economic and market forecasts, you've wasted 10 minutes."

- "There's no shame in losing money on a stock. Everybody does it. What is shameful is to hold on to a stock, or worse, to buy more of it when the fundamentals are deteriorating."

|

| Go for a business that any idiot can run – because sooner or later, any idiot is probably going to run it |

Wednesday 15 June 2016

OCBC scrip dividend received today

This is a review post about OCBC Scrip dividend Scheme.

100 of OCBC shares from the payment of Scrip dividend was credited to 穷小子's CDP account today. Including this, it would be the third time 穷小子 had opted for Scrip Dividend Scheme.

The decision made in May to opt for shares has been right so far.

To recap, the scrip dividend price is $8.11, the price which is after the 10% discount from the determined price at $9.01.

If 穷小子 have opted for Cash dividend instead, he would have received $810.18 only, rather than the value of $845.00 today. Although it seems to be a difference of $34.82 only, it is actually an additional of 4.29%.

Moreover, this 100 of OCBC shares will be included in the formula for computing the next scrip dividend which usually falls on August, about two months from now on. Let it Grow! Let it Grow!

The power of Scrip dividend and Compounding effects.

100 of OCBC shares from the payment of Scrip dividend was credited to 穷小子's CDP account today. Including this, it would be the third time 穷小子 had opted for Scrip Dividend Scheme.

The decision made in May to opt for shares has been right so far.

To recap, the scrip dividend price is $8.11, the price which is after the 10% discount from the determined price at $9.01.

Dividend Announced

|

$0.18 per share

|

Cash dividend value

|

$810.18

|

Amount of shares received via Scrip Dividend

|

100

|

Determined Price for Scrip Dividend (after 10% discount)

|

$8.11

|

Scrip Dividend Price as of 28 Apr 2016

|

$811.00

|

Last Closed Price

|

$8.45

|

Scrip Dividend Price as of today

|

$845.00

|

|

| For anyone who needs the events timeline information |

Moreover, this 100 of OCBC shares will be included in the formula for computing the next scrip dividend which usually falls on August, about two months from now on. Let it Grow! Let it Grow!

The power of Scrip dividend and Compounding effects.

Friday 3 June 2016

Sold off Noble after 5 years.. Finally!!

Sold off my Noble after holding for more than 5 years.. Finally!! Have mentioned before that this is one of the few major bad decisions which were made so far. Well, the price which I bought was at $2.16 to be exact, with 3000 shares. In another words, I just write off a huge 88% loss, more than $5,000 from my portfolio today. This post shall and must be parked under "Mistakes" category to remind myself about it. It is really an expensive and painful mistake indeed.

Made a series of bad decision in this actually:

Honestly, to begin with, I can't even remember why this was bought in the first place. Based on Yahoo finance, $2.16 is very near the all-time high of $2.51, which was somewhere around 2008.

Didn't read any of its financial reports at that point of time. It was bought purely with guts feel, speculations and gambling style. Another minor factor is I don't wish to miss the price, afraid that it may goes higher.

Speculates and gamble. Impatient.

When the price began to drop to a low of $1.05 by the end of 2011, a naive decision was made. Can't remember much clearly again, but the decision to hold onto it was much based on the price movement. Since it came down from a high of $2.84(est.) to a low of $0.47 (est.) in 2008 and managed to come back to a $2.34(est.) in 2011. I was just hoping the same would happened this time.

I truly understand what is "history doesn't tells you the the future" means now.

The price was ranged around $0.81 to $1.44 from 2011. I didn't pay much attention in Noble during this period, just hold it and hoping that the price could reach $2 one day.

False hope.

When the reports by Iceberg Research and Muddy Waters in 2015, that is point when I start to take note about this stock again. Yet I didn't study their report again but only by reading the reports from Iceberg Research and Muddy Waters, and their target price was $0.10. Perhaps I'm in a denial stage at this point of time. Only thinking that since have already suffered from more than 50% loss in this, how much can it gets worse. The price shall recovers once this incident cleared. All these are just noises in the market, and Noble had rejected all of these allegations after all.

Nobody would admits even though if the allegations are true right?

When Noble's CEO unexpectedly announced that he will resigned due to family reasons earlier this week, this is the time when I am finally awakes. It was too late, the price was at $0.30, already incurred a 85% paper loss. I am waiting for a better price to get out this time.

Paper loss should be considered as a loss too

Today Noble Group founder and Chairman announced to step down within 12 months. Noble also said it would cut headcount and together with rights issue announcement: